Can you imagine a more idiotic challenge than to see which business can use up it’s investment capital and be forced out of business first?

Its what happens each time a new business opens with no strategy other than to sell at a lower price.

Dropping price doesn’t work. Long term, it never works. And in the short term it can’t create long term customers.

Let’s create a hypothetical example:

John finds a Chinese source for an 8mb off-brand MP3 player, which he can buy in quantity for $10 each. John checks eBay and finds the comparable offerings are priced at $40 each.

“Wow,” says John. “Those other sellers are being greedy. I’ll mark mine $30 each and sell a TON of ’em.” He estimates the cost of shipping, discovering it will cost roughly $6. John decides to charge $10 for shipping “and handling.”

Thinking he will quickly sell all 100 units at $20 profit, plus a $4 shipping markup, he’s counting on taking in $2,400, and making a net profit of $1,400.

John invests $1,000 dollars, purchases 100 players, and is now in business. He lists them on eBay for $30, plus $10 shipping and handling.

John is right. There is a demand at that price point. He sells 16 the first day and 17 the second.

On the third day John makes no sales. Worried, he browses eBay to figure out why.

What’s this? This guy “Tom” has the same player listed at $27. Worried, John drops his price to $25, and sells five more before, again, his sales abruptly stop. He finds Tom’s eBay store is still selling them at $27. Puzzled, he digs a bit deeper and discovers “Bob” now has ’em for only $22.

John ponders. “Well, I’ve made some money on these. I think its time to get out of the MP3 player business.” He drops his price to $15, offers free shipping, and expects to blow out the remainder and retire.

John sells 16 more before his sales again stop. He checks. Tom is reacting to the new competition by selling his players at $11 each.

John cuts price below his cost, and offers his last 27 units at $8.50, plus free shipping. Another 19 are sold before “Andrew” offers the same player for $7.50, and free shipping.

Tired of losing money, John contacts Tom, Bob, and Andrew, and offers his last 27 units to them for $270. None of them take him up on the offer.

John cancels his eBay account, and determines everyone on his Christmas list will get an MP3 player for Christmas.

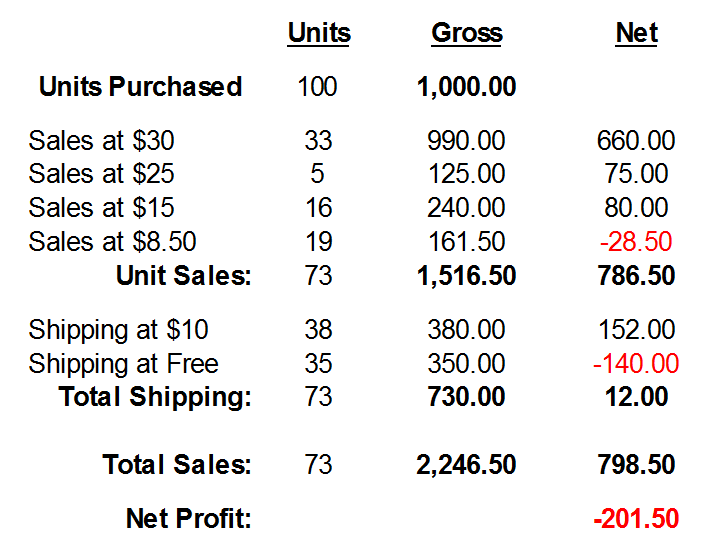

Shall we calculate John’s profit on this venture?

Ouch!

John could be considered a dabbler. A great many eBay sellers are.

Some, on the other hand operate real businesses. Look at the feedback scores. Nobody gets to thousands of transactions as a dabbler.

People like John are not the folks Dun & Bradstreet speak of when they report 6 out of 10 businesses with 20 employees or less don’t make it past their first year, and 9 out of 10 don’t make it to their 10th anniversary.

D&B goes on to say that only 10 percent of all of the business failures in the US file for bankruptcy. The rest close voluntarily because operating their companies turn out to be way too much work for the meager income they provide.

The biggest cause of insufficient income?

Pricing too low.

Why? Because all of a new businesses operating costs are higher.

A new businesses can’t BUY inventory at a lower price than the big box stores. It can’t ship at a lower price. And it doesn’t spend enough on advertising to buy in the bulk required to get reduced pricing there, either.

Combine higher operating costs and lower profits with discounted pricing, and you have a situation my friend and colleague, Jeff Sexton, refers to as the “race to the bottom.”

With lower price as your selling strategy, you’re competing with at least eight other ventures already in the process of going out of business.

What’s the Solution?

Raise your prices.

“C’mon, McKay,” I hear you asking. “Just how do you suggest I raise prices in a bad economy when all of my competitors charge so little?”

Ah. Fair question. We’ll discuss that in a couple of days, as we continue fishing for customers.

Your Guide,

Chuck McKay

Your Fishing for Customers guide, Chuck McKay, gets people to buy more of what you sell.

Your Fishing for Customers guide, Chuck McKay, gets people to buy more of what you sell.

Got questions about pricing for profit? Drop Chuck a note at ChuckMcKay@ChuckMcKayOnLine.com. Or call him at 304-523-0163.